Is Automation the Answer?

“This has to be a render,” wrote Jesus Diaz, author and contributor at Co.Design, in his November 2017 article on grocery e-commerce. But what looks like a 3D depiction is actually 100% real robots zooming across a highly sophisticated product grid filling online grocery orders for real customers.

The British-based company, Ocado, is the world’s largest automated warehouse for grocery fulfillment. At its Andover warehouse, a swarm of 1,000 robots navigate a grid the size of a football field to fill orders and replace stock. The new system, which went live in mid-2017, can fulfill a 50-item order in under five minutes–well under the two hours it takes at a human-only operating facility.

Those of us in the industry know that grocery e-commerce will be an integral part of the food future, but is robot automation the answer?

WHY IT’S HAPPENING

Unemployment rates and minimum wage growth suggest automated fulfillment will become a necessity in the near future. As Chris Rupkey, chief economist at MUFG in New York, lamented to Reuters in August 2017, “Companies are running out of workers to hire to do the job or even train to do the work” that needs to be done1. The ratio of job openings to unemployment also hit a 16-year high in August, signaling the widening gap between job openings and available candidate skills mismatch.

Retailers are also increasingly paying more for even low-skilled positions, like those filling and delivering online grocery orders. In 2017, only 20 states match the federal minimum wage of $7.25 and nine of those introduced legislation in the last twelve months to increase their state wage2.

If both trends continue, retailers will soon be out of staff and out of dollars to continue their current service model.

WHAT WE THINK

Even the likely adoption of automated grocery ordering will still not replace the necessity of in-person shopping trips.

In their 2017 “Groceries 2.0” report, Field Agent found that 62% of U.S. consumers said they wanted alternatives to traditional, in-store grocery shopping. While consumers like the idea of forgoing the frequent trips to a grocery store, over 60% said they don’t shop online because they’d lose the ability to personally inspect sensitive items like produce.

Technology is incredibly efficient, but we’re a long way from algorithms successfully replicating the human nuances of grocery selection.

WHAT’S NEXT

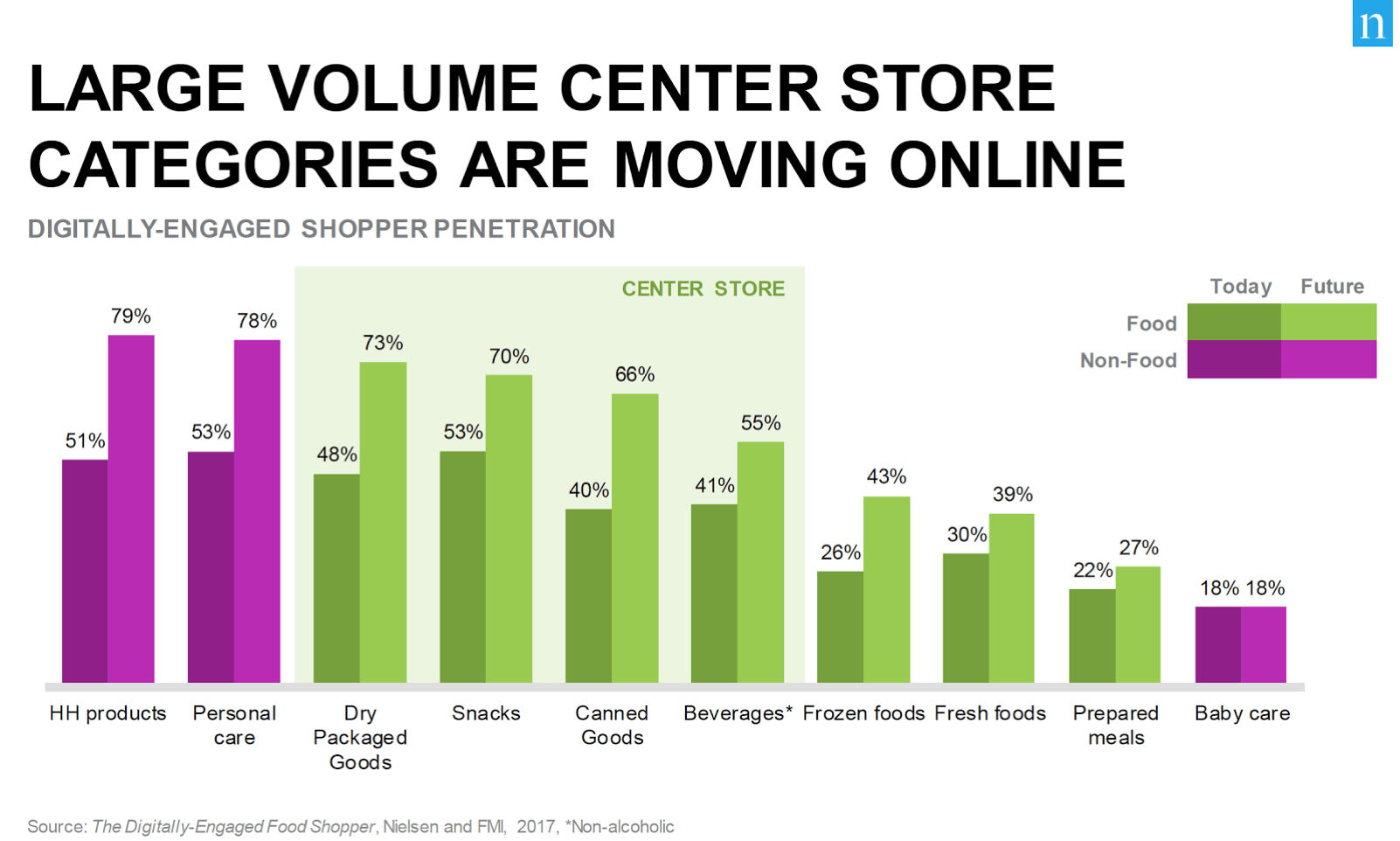

Knowing that both online and in-person grocery will be part of our customer’s future, we as food marketers should adjust our e-commerce strategies based on where our brands/products reside in brick-and-mortar stores. As The Nielsen Company found in its 2017 research, traditional center-store items are migrating online, while perimeter and fresh goods remain in-store purchases3.

Center-Store Brands/Products

- The Challenge: Online shoppers are less brand-focused compared to when they shop in-store, meaning they’re more likely to switch to another national brand or store brand during e-commerce shopping trips.

- The Opportunity: Consumers who frequently shop online are more willing to try new products in many shelf-stable categories than in-store shopping consumers. Online shoppers are also more likely to make online impulse purchases in center-store categories than their in-store counterparts. These insights should be leveraged, particularly with new-product launches.

Fresh Perimeter

- The Challenge: With online shopping available, basket size at in-person visits continues to decline.

- The Opportunity: Shoppers are craving more surprise and innovation at in-person retailer visits. Brands and retailers must work together to build basket rings by providing more excitement, and more day-to-day enjoyment of food than what’s being offered today. Case in point: Sainsbury’s “Try Something New Today” campaign transformed their business by persuading customers to add just one more item to their basket.

Just some Thought for Food™

1 “U.S. Job Openings at Record High; Labor Market Tightening.” Reuters. 8 August 2017.

2 “2017 Minimum Wage By State.” Bankrate. 2017.

3 “What’s Next in E-Commerce?” The Nielsen Company. 2017.